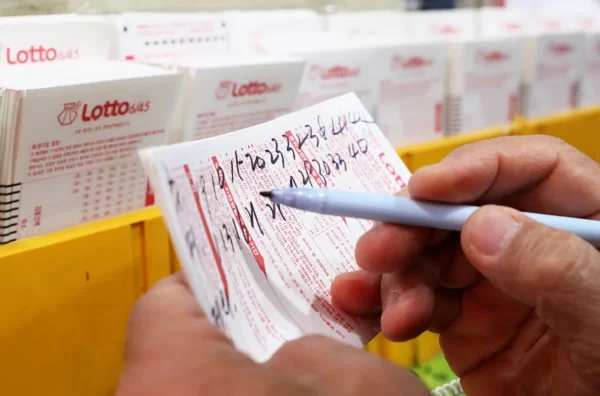

안전놀이터: 토토친구의 안전한 게임 천국

안전놀이터의 중요성과 토토친구의 역할 안전놀이터는 온라인 베팅 공간에서 가장 중요한 요소 중 하나입니다. 사용자의 안전과 금융 보안을 보장하는 것이 핵심이며, 이는 토토친구의 주된 목표입니다. 토토친구는 신뢰할 수 있는 안전놀이터를 선별하여 추천하며, 사용자들에게 검증된 정보를 제공합니다. 이를 통해 사용자들은 더욱 안심하고 게임을 즐길 수 있습니다. 토토친구의 빅데이터 기반 추천 시스템 토토친구는...